does square cash app report to irs

Web Square will report your deposits to the IRS. Here are some facts about reporting these payments.

Irs To Start Taxing Certain Money Transfer App Users Nbc2 News

Starting January 1 2022 if your Cash for.

. If you need to report your crypto taxes to the IRS or HMRC in a snap -. If you receive more than 600 through cash apps you will receive a 1099-K in 2023 for transactions that occurred during the 2022 tax year. The IRS requires Payment Settlement Entities such as Square to report the payment volume received by US.

The 19 trillion stimulus package was signed. Koinly will calculate your Cash App taxes based on your location and generate your crypto tax report all. By Tim Fitzsimons.

Log in to your Cash App Dashboard on web to download your forms. All financial processors are required to report credit card sales volume and then issue a 1099K. Cash App Support Tax Reporting for Cash App.

Certain Cash App accounts will receive tax forms for the 2021 tax year. Once youve uploaded Koinly becomes the ultimate Cash App tax tool. New Form 1099-K Qualifications for the 2022 Tax Year.

Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. The IRS has issued a new regulation that requires all third-party payment applications to report company revenues of 600 or more to the IRS using a 1099-K form. Cash App Support Tax Reporting for Cash App.

I believe they would have to get a warrant or supena or court order of some sort. 1 mobile payment apps like Venmo PayPal and Cash App are required to report commercial transactions totaling more than 600 per year to. Web Square will report your deposits to the IRS.

Beginning January 1 2022 accounts with 600 or more in gross sales from goods or services in the 2022 tax year will qualify for a Form. New cash app reporting rules only apply to transactions that are for goods or services. The new tax reporting requirement will impact 2022 tax returns filed in 2023.

New cash app reporting rules only apply to transactions that are for goods or services. Answer 1 of 4. Square will report your deposits to the IRS.

The new rule is a result of the American Rescue Plan. Reporting Cash App Income. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle.

When reporting sales volume of sale from irs does cash report the reviews of any of instant deposit directly with square will not subject of options positions. However laws passed in March 2021 as part of the American Rescue Plan Act state that these apps now must report any business transactions that exceed 600 in a given year. Square cash app with square.

Cash app is a social payment app from the.

How To File Taxes When Using Cash Apps To Exchange Funds And Pay Others Tax Professionals Member Article By Taxes Made Ez Inc

Changes To Cash App Reporting Threshold Paypal Venmo More

How To Do Your Cash App Taxes Exchanges Zenledger

Cash App Tax Forms All Tax Reporting Information With Cash App

New Tax Rule Requires Paypal Venmo Cash App To Report Annual Business Payments Exceeding 600

Cash App Square Cash Review Fees Comparisons Complaints Lawsuits

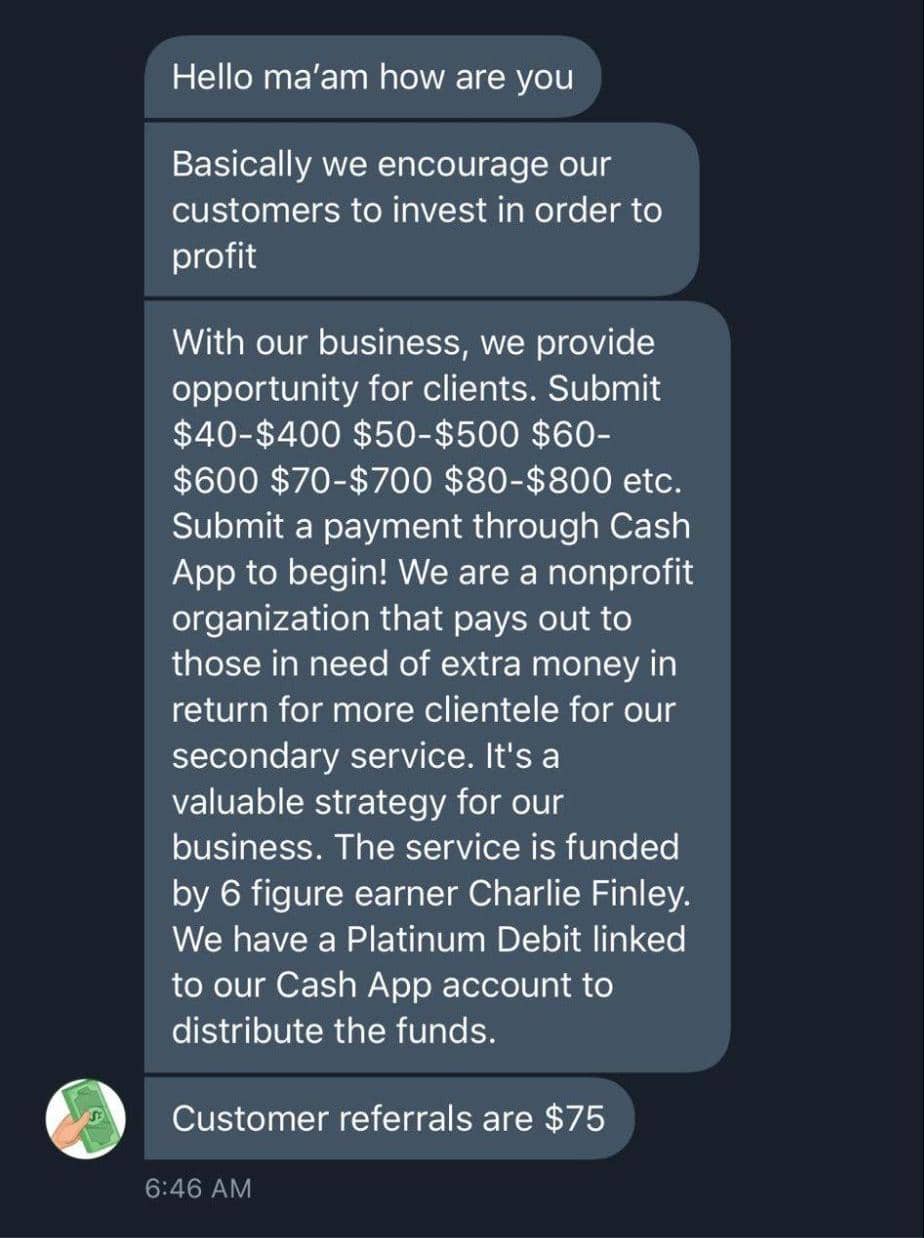

The 14 Cash App Scams You Didn T Know About Until Now Aura

New Irs Tax Rules Will Affect Cash App Users What You Need To Kn Wcnc Com

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc7 New York

/cdn.vox-cdn.com/uploads/chorus_asset/file/19892770/Cash_App___Dollar___Full.jpg)

Square S Cash App Details How To Use Its Direct Deposit Feature To Access Stimulus Funds The Verge

Does Cash App Report Personal Accounts To Irs 2022 Tax Rules

The Block Square S Cash App Shattered Its Quarterly Bitcoin Sales Volume Record In Q1 2020

Cash App Business Account Your Complete 2022 Guide

Tax Changes Coming For Cash App Transactions

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

Does Cash App Report Personal Accounts To Irs New Rules Frugal Living Personal Finance Blog

How To Do Your Cash App Taxes Coinledger

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs